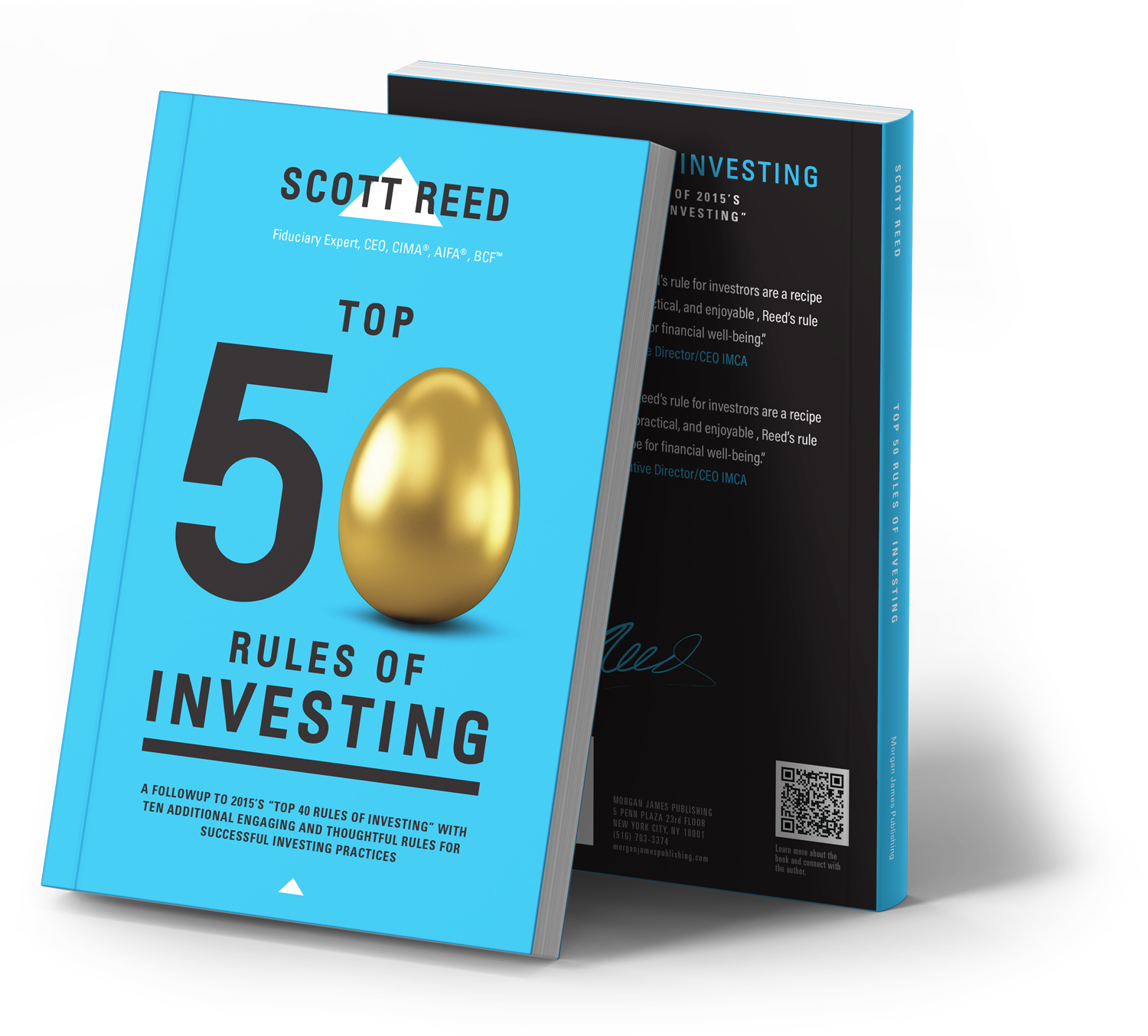

top 50 rules of investing

An engaging and thoughtful guide down the path of successful investing practices.

Some of these rules were learned the hard way and some are based on empirical evidence. In either case, they have all been confirmed by me in my 30-year journey as an investment advisor.

SCott reed

#2

Invest In Others

You will find that helping other people has a lot of hidden benefits. You could be clearing debris from city streets (it’s not just for prisoners). You could be feeding people at the Salvation Army, or you could be sitting on an investment committee deciding how to invest people’ donations in an appropriate way. Whatever your job, there is much to learn about living right, saving money, the cost of being wasteful, and the duty you have to those who are counting on you.

#18

Cost Always Matters

It is important to know when the time is right to pay up and make an educated decision to do so. It will make a huge difference in the long run and your portfolio will thank you.

#44

Put Your Money In Buckets

Finding a client’s risk tolerance is a big deal in our industry. A friend of mine once told me that we spend time trying to deter- mine the maximum amount of risk that a client can stand and then forcing them to accept that risk for the rest of their lives.

About the author

Scott Reed

Fiduciary Expert, CEO, CIMA®, AIFA®

Scott Reed, AIFA®, CIMA®, CEFEX Analyst, is the CEO of Hardy Reed, LLC, one of the nation’s leading fiduciary consulting firms. Over the past ten years, Scott has spoken to national and regional conferences, becoming one of the most respected and entertaining voices in the industry dealing with fiduciary excellence and ethics. Scott provides a unique perspective having served on over 30 non-profit boards the past 25 years, in addition to his role as CEO of one of the first firms globally to be CEFEX® Certified.

“Scott often says: “Investing ain’t rocket-surgery!” Ignore those fancy, but incomprehensible, investment schemes and advertisements for too good to bet rue financial products. Instead, ENJOY reading Scott’s down-home yet PRACTICAL guide to those things that really make a difference, both in financial wellness and life in general.”

Barry Flagg, President : Founder and Inventor of Veralytic Inc.

what people are saying